Buying a home - Part 1

Buying a home is one of the biggest financial decisions most of us will ever make. And because it’s not something we do every day, the home-buying process can be daunting for both first-time buyers and existing homeowners alike. Poor decisions could cost you thousands of pounds and good decisions save you similar sums.

If buying a home is right for you (whether you’re a first-time buyer or you’re moving home), it’ll be easier and less stressful if you follow a sensible process.

In a series of 5 guides we set out all what you need to know and do to help you on this journey.

Overview

Part 1 - Four things to consider about buying a house

Part 2 – 12 things to consider in choosing a home

Part 3 – 3 steps to financing your home

Part 4 – How to negotiate the purchase of your new home

Part 5 – The mechanics of buying your new home

Buying a home - Part 1: Four things to consider about buying a house

In this article, we will go over:

- Is buying right for you…right now?

- The costs and risks of home ownership

- The benefits of home ownership

- Should you sell before you buy?

1. Is buying right for you... right now?

The conventional wisdom for owning your own home is often reinforced with phrases like, ‘you need to get on the housing ladder as soon as you can’ and ‘paying rent is like pouring money down the drain’…

But real life is not this simple – and whilst buying a home (or moving up the housing ladder) can offer significant benefits, it also presents risks to your finances.

Here are some key issues to consider, to help you decide if buying a home is right for you – right now.

2. The costs and risks of home ownership

You're likely to pay a lot to borrow the money

Did you know that on a mortgage of £100,000* over 25 years at an average interest rate of 5%** you’ll repay about £175,000 in total?

That’s about £75,000 in interest that you’ll pay to your lender. You might also think of that as ‘money down the drain’ as it’s effectively rent on the money you borrow to buy your own home.

*Scale these numbers up or down for your mortgage. e.g. on a similar type of mortgage of £200,000, you’d repay £350,000 in total.

**5% p.a. is higher than standard mortgage rates at the time of writing. But interest rates are currently at historic lows and we should not assume they’ll stay down at these levels over the long term. An economic recession could mean interest rates are held down for a number of years – but that would pose risks to house prices.

You'll have to cover a lot of buying & selling costs

Be aware of all the upfront costs of buying a home. These include things like: legal fees, mortgage and valuation fees and stamp duty if that applies to you (first-time buyers enjoy a higher tax-free threshold for stamp duty).

Add in your ongoing costs of home ownership – like buildings insurance and the potential costs to maintain your property – which could be considerable depending on the condition or age of the property you’re buying. Boilers, windows and roofs are expensive.

And, if you’ll want to sell up and move on in a few years’ time (as many people do) you need to factor in your sales costs (like estate agency and more legal work) as well.

You could face a significant risk to your capital

You might like to think of your home as a place to live rather than an investment, but it’s also only natural to hope that your home rises in value during the time you own it.

However, to compare home ownership to renting (which allows you to move on at a much lower cost) you need to consider the financial risks if you have to sell your home after a short period of ownership.

Clearly in this case, any upfront costs and falls in property prices will matter a lot. The value of your home will need to have risen by several percentage points between the time you buy and sell it, just to cover those costs and make you better off than you would have been by renting.

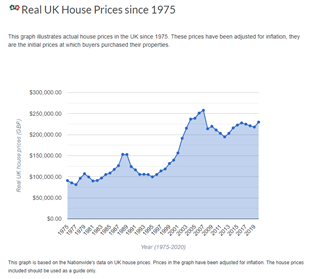

Property prices are not guaranteed to go up every year and sometimes when property prices are at an all-time high, they can fall in value quite a lot, such as in the early 1990s and the global financial crisis of 2008-09. Also, if your mortgage is going to be a high proportion of your home value, your risk of falling into negative equity* in a property market downturn, is much higher too.

*Being in negative equity (where the sale value of your home is less than you would need to clear your mortgage) is a stressful situation if you want to sell your home (for whatever reason) at that time.

3. The benefits of home ownership

You could save a lot of money over the long term

Whilst you might fix your mortgage payments for periods of time, over the long term these payments will rise and fall with interest rates generally – but they won’t increase year after year, in line with inflation like a rental payment.

Once you’ve repaid your mortgage, you’ll be free of those monthly repayments altogether – unlike rental payments which never stop.

So, all things being equal, you’d expect to pay out less to buy a home for life than to rent a similar property from a private landlord. After all, with your own home, you’re not paying for the landlord’s profit. You might find that your monthly mortgage costs could be less than rental payments on a similar type of property – even if you have a relatively large mortgage as a proportion of your home value.

You could build a lot of wealth in your home

The upside is you could build a great deal of wealth through homeownership. And for many people, their home is the most valuable asset they’ll acquire in life.

By a combination of your home value rising and/or your mortgage debt being eliminated through your repayments, you could build up a sizable amount of equity in your property over time. It’s up to you what you do with your equity (equity is the value of your home less any debts you owe on it).

So, you could:

- Continue living in your home for very little cost once your mortgage is paid off

- Rent out your property for a time, to generate an income

- Extend your mortgage (or remortgage) to release some of the equity

- Release some of that equity (if you’re over 55) to boost your income whilst staying in your home. More on this here

- Sell your home (and enjoy currently tax-free proceeds) to use as you want – perhaps as a large deposit on your next home or, in later life, to buy a smaller home – using any remaining balance to boost your income

And, if you buy your home at a fair price you could do very well financially from home ownership. Certainly, the long-term history of UK property prices is on your side.

4. Should you sell before you buy?

Most existing homeowners complete the transaction to buy their next home on the same day as they sell their existing one.

This avoids the risk of being out of the property market if prices are rising – and avoids the inconvenience of moving home twice (first to rented accommodation and then to their new home) in quick succession.

However, there can be advantages to selling your home in advance of buying your next one. It’s certainly worth noting the pros and cons to this approach and these are nicely set out here.

Next steps

We suggest that you avoid any rule-of-thumb or ‘common sense’ guidance you hear and weigh up the costs, risks and benefits of home ownership, taking account of your personal situation now – and looking ahead to your future.

In the next blog in this series we explain the 12 things to consider when choosing a home to buy, click to read.

Sign up to our newsletter

Our newsletters bring you the latest articles to help you improve your financial wellbeing.

If you want to consent to receiving our newsletter please enter your email below to subscribe. If at any point you want to withdraw your consent please email hello@salaryfinance.com. For more information about how we use your personal data see our privacy notice.