Spend Smarter with Salary Finance

At Salary Finance, we think budgeting needs a makeover. So we’re trying to change the way people approach budgeting. Is there a better way of doing it that doesn't require lots of effort or giving yourself a hard time?

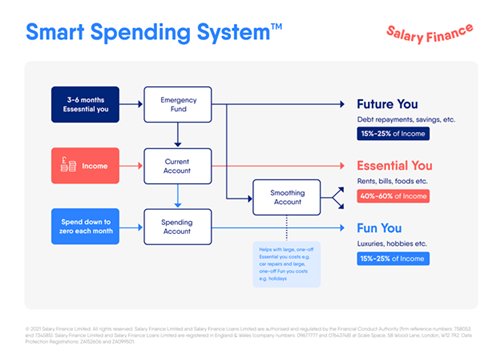

Introducing the Smart Spending System:

There are elements to the Smart Spending System:

- Future You (savings, pension, investments)

- Essential You (bills, rent, food, transport)

- Fun You (your passions, hobbies and treats).

It’s very easy to overspend in some of these areas and under-spend in others, especially when life gets in the way. To get the most out of the Smart Spending System, you decide before you get paid, where you want your money to go between the three Yous: How much you allocate to each ‘You’ will depend on your personal circumstances and priorities but as a rough guide aim for:

- Around 50% to Essential You,

- Around 20% to Future You

- And around 30% to Fun You.

To get started with thinking about your money, click here to download our Smart Spending Planner. Make sure you spend some time looking at what you’re spending (and on what!) and fill the planner out. Writing it all down on paper can be a bit of a shock but maybe now is the time to spring clean your finances?

To empower you to stick to your Fun You spending allowance, it can make it easier to open a second bank account - maybe a Monzo, Starling or Revolut - so you can see your spending and know what you have left.

One thing to consider when trying to get better with money is being less hard on yourself - if you completely restrict yourself and beat yourself up when you have fun, it’s difficult to build a positive relationship with your finances.

Take control of your money and give yourself permission to spend your allocated fun money in the knowledge that you’re managing your money in a way that covers all bases, including your financial future.

Sign up to our newsletter

Our newsletters bring you the latest articles to help you improve your financial wellbeing.

If you want to consent to receiving our newsletter please enter your email below to subscribe. If at any point you want to withdraw your consent please email hello@salaryfinance.com. For more information about how we use your personal data see our privacy notice.