Managing your money with children - Part 2

What’s in this guide?

This guide aims to explain how you can reduce the stress of managing your money, allowing you more time to spend with your children and enjoying each step of the journey. We only touch on some of the topics and tips for this, so we recommend you use this as a starting point and follow up to find out more on the issues that affect you.

If you’ve not already done so, you might want to read part 1 of our blog on this issue here.

Jump to:Find the right home in the right location

Having children brings this challenge into sharp focus. If your family’s getting bigger and you need more space, or if you want your children to attend a particular school, you might have to move.

There are a lot of factors to consider when moving home with children and schools in mind. So, do your research on your preferred schools and on your potential new home. In terms of the home, be sure to view it on different days and at different times - and, if it’s a university area, during term time too.

If you’re unsure about the area, you can always try before you buy by renting first.

Check out our blog for more insights on home buying.

Protect your family

Unfortunately having children can make you think about the morbid possibility of not always being there, and if you’ve not recently reviewed health and life insurance cover for yourself, then this is for you. A great way to start tackling this issue is with a simple question:

How much are you worth?

Have a good think about how much money you or your family would need to carry on your (or their) lives in the way you’d want, if you were to suddenly die or suffer a serious illness.

Some employers may provide Life Insurance, which is worth looking at to understand what is provided and what additional cover you may want to purchase. In the event of a serious illness, your earnings may be massively reduced - after any short period of support from your employer - and it is worthwhile considering how your family would cope.

When considering your ‘worth’ don’t forget the unpaid work you do each week to keep things running smoothly at home – and who would do that work if something happened to you. Or, if you don’t do most of the home chores, who does it for you? And what would it cost to pay someone else to do that work, if your partner / homemaker was no longer there or able to help.

Insure yourselves - it’s not as scary or costly as you think

Most people don’t think the worst will happen to them and many people avoid thinking about it. But, with children (and/or partners) involved, the potential impact of a life or health disaster can be enormous.

Thankfully, because the chances of these disasters are (normally) low, the cost to insure against them are, typically, very low too.

For example, a life insurance policy that pays out £250,000 in the event of death at any time within a 10-year term, might cost a healthy 30-year-old less than 33p a day (£10/month). And whilst insuring against long term illness is a bit more expensive, all these types of insurance (if bought whilst you’re relatively young and in good health) are very low cost for the peace of mind they can give you and your loved ones.

Take action now

As with most things in financial planning, the need for action is easy to understand. But working out how much cover and what policy you need, sourcing and sifting through quotes to check their terms and conditions – and exclusions – as well as setting up trusts for life insurance, can be a chore. Talk to your employer to find out what, if any, life and ill health cover they already provide for you. Or, what extra cover they could offer at a competitive cost.

There are a number of resources to help decide what type of insurance and cover is best suited to you and your circumstances:

Start funding your child’s future

If you want to build a fund to help a child through university, college or training – this is for you.

If you don’t have money already set aside for this goal, you may want to start saving (or investing) for it as soon as you can – for two reasons:

1. First (and unlike your other goals), you can’t delay this one. You really can’t tell your child to delay their studies whilst you catch up on your savings plan.

2. Second, a delayed start either means that your payments will be a LOT higher when you do start saving… Or there’ll be a lot less money to support your child with their studies.

Saving over the long term is the best solution but what should you save or invest into?

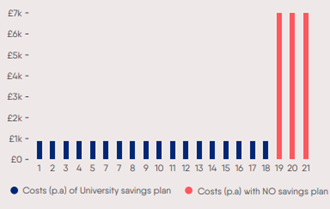

A regular investment of about £75 per month (£900 each year) over 18 years could potentially deliver the £21,000 fund you want to support your child when they start further education. These numbers are all in today’s money terms and assume 3.5% p.a. real investment returns and that the regular investment input is maintained in line with inflation over time.

Delaying the start to your savings on this goal for, say, 9 years (halfway to 18) would more than double what you’ll need to put in.

So, instead of £75 per month, you’d need to start saving £170 per month to reach the same target – that’s if we assume the same growth rate on your money. However, you might not want to take as much investment risk when you’re closer to your financial goal. So, you might then reduce the assumed return on your money, which would increase your required input amount further.

A 9-year delay before you started saving into standard bank accounts might mean you’d need to save nearly £200 per month to reach your target. That’s nearly three times as much each month – compared to if you started saving when your child was born. And remember, these numbers are all in today’s money terms. Future inflation will simply increase the amount you have to save.

This picture sums up two extreme funding options for a parent (with no existing funds set aside) who wants to provide £7,000 of maintenance support to their child for three years of university (so, that’s £21,000 total)

What should you save or invest into?

The right type of financial product for you, and the best types of fund to hold inside that product, will depend on many factors, including: the size of fund you’re looking to build, any funds you have set aside now (or expect to have in the future) and other aspects of your personal financial situation and attitude to investment risk.

So, it’s impossible to provide specific solutions in a guide like this. However, we can say that to make smart money decisions you need to follow a smart money checklist like the one we outlined in this blog - How to choose the right investments for you - or this video in Season Two of our Money Insights.

Wherever you decide to save or invest, you’ll want to keep a close eye on charges – both on the investment product and any advice that you have on it. Overpaying by even 1% or less each year will seriously drag down your investment returns – and hence your final fund.

Managing your money with children - checklist

Finally, this checklist will help you make smart money choices on this – and any other financial life goal that you have. Getting started early on your savings journey is key – and starting with simple bank savings is fine too. You can work out the best regular investment plan for your situation a bit later. Don’t let that job stop you from getting started.

- Understand the cost of raising a child

- Make sure you know what you're entitled to

- Avoid the child benefit tax traps

- Control your spending

- Find the right home in the right location

- Protect your family

- Start funding your child's future