Paying Off debt With the snowball method

Are you ready to tackle your debt? Learn about the different repayment strategies and how to pick the right one for you. Becoming debt-free is possible, and it could help you free up energy, time and money towards other things! There isn't a one-size-fits all strategy, and picking the right option depends on many factors. We’ve outlined a few options below to help you decide what might work for you

The Snowball Method

The Snowball Method centres on creating momentum and motivation. To start off, get the balances on all your non-mortgage debts.

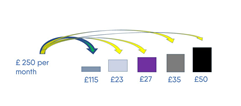

Then line up your debts from smallest to largest. You don't need to pay attention to the interest rate with this method. Then, pay the minimum balance on every debt except the smallest one. For the smallest balance, try to put as much extra money as possible towards it.

Once you pay off the smallest balance, redirect the monthly amount to the next debt until that is repaid, and keep going until you’ve repaid all the debts!

The Snowball Method enables you to see your efforts making a difference right away. And most behavioral experts agree, the power of small wins is incredibly effective for staying motivated.

If your larger debts might take a while to repay, even with the snowball method, it may make sense for you to see if Salary Finance could replace that with a lower cost salary-linked loan. The lower interest will enable you to repay that loan even earlier.

The Snowball Method works because it helps build the confidence and motivation to keep going.

Sign up to our newsletter

Our newsletters bring you the latest articles to help you improve your financial wellbeing.

If you want to consent to receiving our newsletter please enter your email below to subscribe. If at any point you want to withdraw your consent please email hello@salaryfinance.com. For more information about how we use your personal data see our privacy notice.