Making the most of your free money (that’s your workplace pension!)

This blog is about pensions but, before you roll your eyes and stop reading, think about if you’re making the most of your workplace pension...

Who doesn’t like free money? It sounds like a joke, but chances are you get free money (possibly equivalent to a pay rise) from your employer every month by way of your pension.

Usually, when we think about our pensions, we focus on the money we are paying out every month in contributions. But what if you focused on the contributions your employer is putting in instead - because that’s literally free money being put aside for your future.

Pensions can be complicated and, unless you’re nearing retirement age, it can feel like something so distant that it’s not something you need to worry about right now. But by not thinking about it now, you could be missing out on free money. Wouldn’t you rather save sooner and benefit from your employer’s contributions as well as growing your money with interest?

Compound Interest

This sounds complicated. But what it really means is earning interest on your interest. Essentially this is the power of saving long-term.

You get a much higher return and, with your pension, you could find you have more to show when you retire by saving younger but contributing less.

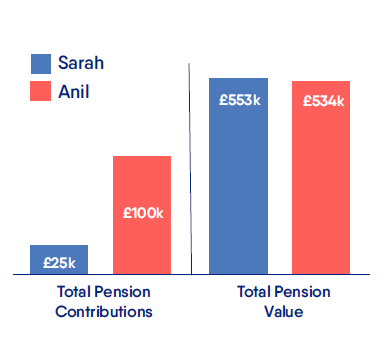

For example, say Sarah starts saving £2,500 per annum into her pension plan when she is 21 and stops saving into her pension when she’s 30. The fund carries on growing at 7% a year, net of any charges, and by the time she’s 70 her pension fund is worth £553,000.

Anil starts saving £2,500 per annum at 31 and carries on contributing until the age of 70. Assuming the same return as Sarah - 7% a year - Anil ends up with a fund worth £534,000. Sarah’s total pension contributions amount to £25,000 and she ends up with a pot worth £553,000. Anil’s contributions come to £100,000 sees his money grow a little more than fivefold.

What this means is, it’s important to start long term investing as soon as you can and save as much as you can.

To find out how your pension contributions affect your take-home and what your employer contributions actually look like (in £s not % - that’s your free cash!) you can use this calculator.

Sign up to our newsletter

Our newsletters bring you the latest articles to help you improve your financial wellbeing.

If you want to consent to receiving our newsletter please enter your email below to subscribe. If at any point you want to withdraw your consent please email hello@salaryfinance.com. For more information about how we use your personal data see our privacy notice.